Are we there yet? Is the hiring market finally taking off ? (a global view)

The most common question I get asked these days, by clients, candidates, journalists and even my own staff, is whether the job market is improving around the world. Is confidence on the up? Specifically, are employers hiring again, or do they plan to?

To make an informed assessment of the coming quarter, I have looked at our business activity in the countries and cities where Firebrand operates. Are job orders increasing in volume? What are our clients hiring plans? Are decisions being made a little quicker? I have also gone right to the coalface to get an opinion from people who are immersed in hiring and placing marketing, creative and digital professionals. I asked our senior management across the Firebrand world this simple question…

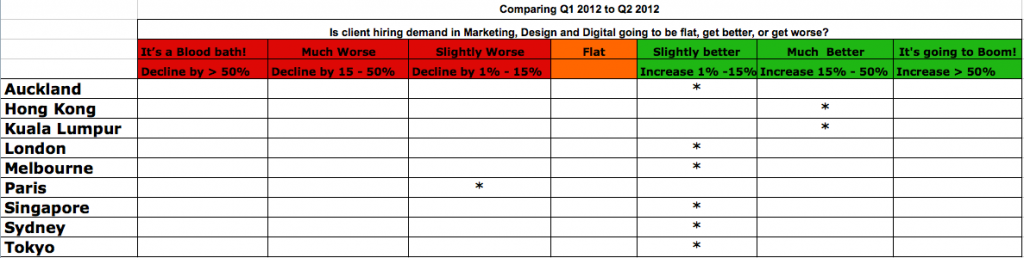

Comparing Q2 2012 to Q1 2012, is client hiring demand in marketing, creative and digital going to be flat, get better, or get worse?

So, although not scientific, the chart below reflects our observations and informed predictions for permanent and search recruitment, based on client feedback, our own WIP pipelines, and a bit of pure recruiter instinct.

Europe is still very challenging, with patchy signs of life at best. In the UK we have seen a slow but discernible increase in demand, and Q2 will continue this trend. It’s still possible that the UK will slip back into recession, but this will likely be short and not unduly impact the high demand areas that we operate in, specifically digital design and production and online marketing, e-commerce and SEO.

France has been the surprise package in Q1. Notwithstanding all the challenges that economy faces, we have had steady demand for digital and marketing staff, with the luxury sector a stand out. However, we are rating the Paris market a ‘small decline’ in Q2, mostly because of the distracting impact of the French Presidential election in May as well as the large number of public holidays in France in Q2.

In Asia, Hong Kong and Kuala Lumpur are the standouts. After a slow start to the year, where an early Chinese New Year and bad news out of Europe were contributing factors, we see confidence and hiring across the board in these markets. In fact, it seems Malaysia is on the cusp of a mini jobs boom. Orders are pouring into the Firebrand office across all sectors — Advertising, Media, Digital & PR. Early signs of an overheated market, such as increasing salaries and counter offers are emerging, and many clients are experiencing disappointment as they move too slowly or fail to appreciate the salary increments needed to secure the best talent. We expect this momentum to continue well into Q2.

Sentiment in Hong Kong is strong too and we expect this to continue, although a potential slowdown in China will certainly impact the second half of the year in Hong Kong.

Singapore has a large financial sector, which has been severely impacted by the global crises, and job losses have been severe, impacting confidence across the entire economy. As a result, some clients froze headcount in Q1. We sense a thawing now, and job orders volumes are increasing in the Firebrand Singapore business, although it must be said that decisions to hire are sometimes slow in coming. We continue to see hiring in Ad agencies and also in the PR sector, and online marketing is a growth area. We predict a small, slow growth as Q2 unfolds.

Resilient Japan has bounced back from the natural disasters of 2011, and has also survived questionable government, corporate scandals, and the Euro crisis. The depreciating Yen is assisting Japanese exporters, and while we predict no job boom, we are seeing increased hiring in digital design, e-commerce and social media.

The Australian economy is in much worse shape than the politicians would have us believe, relying so heavily as it does on the resources sector (which clouds recession in other sectors) and facing the very real impact of the carbon tax. Hiring was subdued throughout 2011 and indeed, the latest surveys of hiring intent show sentiment to be at its lowest point since 2008. However it is also true that some companies are hiring specific skills sets. Indeed, we see many employers laying people off, while hiring at the same time, as they re-calibrate their skills balance sheet.

Even so, we describe the Sydney market as cautiously optimistic, and we are seeing more orders, albeit in very niche areas such as PR Account Managers with health care experience, UX designers and Social Media Community Managers.

The Firebrand Melbourne team report that many of their conversations with clients are about planning future hires during Q2 and for later in the year, confirming our belief that Melbourne actually has a stronger job market than Sydney in our sector.

New Zealand was very slow in 2011. Even now we detect, at best, tentative optimism from our clients, who are focused more on consolidation than growth in the short term. Q2 will be stronger than Q1, but there is no sign of an immediate catalyst for a surge in hiring.

So, a mixed bag across the world as you would expect. But overall it seems job creation is back and, although cautious, hiring is on the increase, especially in Asia.

*****************************************************************************************************

Subscribe to The Savage Truth, ‘Like’ our Facebook page, and connect with Greg on LinkedIn to ensure you get your recruiting brain-food fix.

******************************************************************************************************

-

Comment by Tim Spagnola on April 17, 2012 at 6:46am

-

Great post Greg - thanks for sharing

-

Comment by bill josephson on April 17, 2012 at 7:42am

-

Based on what I read, since only recruiting in the US, I can't see where any job market is doing great aside from emerging markets. I see Asia/India (except Japan), Russia, Brazil, Peru Chile, Bulgaria and other cheap labor, cheap cost of doing business, future business revenue stream, and growing countries where the jobs are/will be.

The expensive mature economy countries with high cost of doing business, heavy taxes, burdensome government regulations and mandates, high cost of living, high labor cost are passe for much jobs creation.

If you want strong jobs growth, government should make it in business' best economic interests for businesses to form and to create jobs. In the US, that certainly isn't happening, IMO. Obamacare, Dodd-Frank Wall Street legislation, sunsetting of Bush Tax Cuts, possible ending of middle class payroll tax cut, Defense spending cuts, possible Cap and Trade legislation, and potential tax increases on jobs creators all means one thing.

If private sector jobs are coming back to the US it will be in spite of government, not because of it IMO.

-

Comment by Suresh on April 18, 2012 at 10:06am

-

Thanks for the summary.

New US jobs created in March was about half that of February, so there is a slowdown here. Could be higher Oil prices, european uncertainty or china slowdown factoring into lesser jobs..

Comment

Subscribe

All the recruiting news you see here, delivered straight to your inbox.

Just enter your e-mail address below

RecruitingBlogs on Twitter

Groups

-

Virtual Recruiters Netwo…

620 members

-

Recruiters On LinkedIn

1801 members

-

Corporate Recruiters

316 members

-

Recruiting tips for begi…

180 members

-

The Recruiting Bar

190 members

-

Recruiting Humor

222 members

-

News from the Recruiting…

34 members

-

Contractors Recruitment

62 members

-

Recruitment Process Outs…

194 members

-

Independent Recruiters

530 members

© 2025 All Rights Reserved

Powered by

![]()

Badges | Report an Issue | Privacy Policy | Terms of Service

About

With over 100K strong in our network, RecruitingBlogs.com is part of the RecruitingDaily.com, LLC family of Recruiting and HR communities.

Our goal is to provide information that is meaningful. Without compromise, our community comes first.

Join the Network!

RecruitingDaily.com

One Reservoir Corporate Drive

4 Research Drive – Suite 402

Shelton, CT 06484

Email us: info@recruitingdaily.com

You need to be a member of RecruitingBlogs to add comments!

Join RecruitingBlogs